Are you looking for a way to stay up-to-date on the latest Bitcoin prices? Look no further than Bitcoin USD: Real-Time Price, Conversion, And Market Updates!

Editor's Notes: Bitcoin USD: Real-Time Price, Conversion, And Market Updates" have published on date. As the leading source of Bitcoin information, we provide real-time price updates, conversion tools, and market analysis to help you make informed decisions about your Bitcoin investments.

Our team of experts has analyzed the latest market data and put together this comprehensive guide to help you understand everything you need to know about Bitcoin USD. We cover everything from the basics of Bitcoin to the latest price trends, so you can make the best possible investment decisions.

| Key Differences | Bitcoin | USD |

|---|---|---|

| Ticker symbol | BTC | USD |

| Price | Varies | Fixed |

| Market cap | Over $1 trillion | Over $19 trillion |

| Inflation rate | Halved every four years | Controlled by the Federal Reserve |

Transition to main article topics

FAQ

This comprehensive FAQ section provides insightful answers to frequently asked questions surrounding Bitcoin's USD value, conversion processes, and market dynamics. Bitcoin USD: Real-Time Price, Conversion, And Market Updates

Question 1: What factors influence the conversion rate between Bitcoin and USD?

The Bitcoin-to-USD conversion rate is determined by a combination of factors, including supply and demand, market sentiment, global economic conditions, and regulatory changes.

Question 2: How can I convert Bitcoin to USD?

To convert Bitcoin to USD, you can utilize cryptocurrency exchanges, which provide platforms for buying and selling digital assets. These exchanges offer various conversion methods, such as market orders and limit orders, allowing you to optimize your transactions.

Question 3: What is the real-time price of Bitcoin in USD?

The real-time price of Bitcoin in USD is constantly fluctuating due to market dynamics. To stay updated on the latest price movements, refer to reputable sources that provide real-time data and charts, ensuring you have the most accurate information for your investment decisions.

Question 4: How does the Bitcoin market differ from traditional financial markets?

The Bitcoin market operates differently from traditional financial markets in several aspects. It is global, decentralized, and operates 24/7 without any central authority or regulation. Due to its unique characteristics, it exhibits high volatility and can be susceptible to sudden price swings.

Question 5: What are the advantages of investing in Bitcoin?

Investing in Bitcoin offers potential advantages, including the potential for high returns, diversification of investment portfolios, and the ability to hedge against inflation. However, it's crucial to remember that Bitcoin investments come with risks, and investors should only allocate funds they are prepared to lose.

Question 6: What resources can provide additional information on Bitcoin and its value?

Numerous resources are available to educate investors about Bitcoin and its value dynamics. These include industry publications, financial news outlets, and reputable cryptocurrency exchanges. Continuous learning is essential to staying informed about market trends and making informed investment decisions.

Remember that investing in Bitcoin, like any financial instrument, involves inherent risks. Conduct thorough research, understand the market dynamics, and proceed with caution to maximize your chances of success.

For further insights into the world of Bitcoin and its market dynamics, explore our comprehensive article on Bitcoin USD: Real-Time Price, Conversion, And Market Updates. This in-depth resource provides additional information and analysis to assist you in navigating the ever-evolving Bitcoin landscape.

Tips

To make informed decisions about Bitcoin investments, consider these practical tips.

Tip 1: Understand Bitcoin's Value Proposition

- Recognize Bitcoin as a decentralized, secure, and transparent digital currency.

- Consider its potential as a store of value and medium of exchange.

Tip 2: Research the Bitcoin Market

- Monitor news, market trends, and expert opinions to gain insights.

- Analyze price charts to identify patterns and potential market drivers.

Tip 3: Consider Risk Tolerance

- Understand that Bitcoin investing involves substantial risk.

- Invest only what one can afford to lose and diversify portfolio accordingly.

Tip 4: Secure Bitcoin Investments

- Store Bitcoin in hardware or software wallets to protect against theft and hacking.

- Enable two-factor authentication (2FA) for all accounts related to Bitcoin holdings.

Tip 5: Set Realistic Expectations

- Recognize that Bitcoin's value is subject to volatility and long-term trends.

- Avoid chasing short-term gains or investing emotionally.

By following these tips, investors can approach Bitcoin with a well-informed and strategic mindset, enabling them to make sound decisions and navigate the market more effectively.

To learn more about Bitcoin's price and market updates, visit our website regularly.

Bitcoin USD: Real-Time Price, Conversion, And Market Updates

To stay informed in the dynamic realm of cryptocurrency trading, understanding key aspects of Bitcoin's value is crucial. These aspects encompass real-time price, conversion, and market updates, providing valuable insights into Bitcoin's position in the ever-evolving financial landscape.

Bitcoin Price History: Price of Bitcoin 2009 - 2022 | SoFi - Amajon.asia - Source amajon.asia

- Real-Time Price: Essential for gauging Bitcoin's current worth in USD.

- Conversion: Facilitates effortless conversion to and from other currencies.

- Market Updates: Provides up-to-date news, analysis, and expert commentary on Bitcoin's market performance.

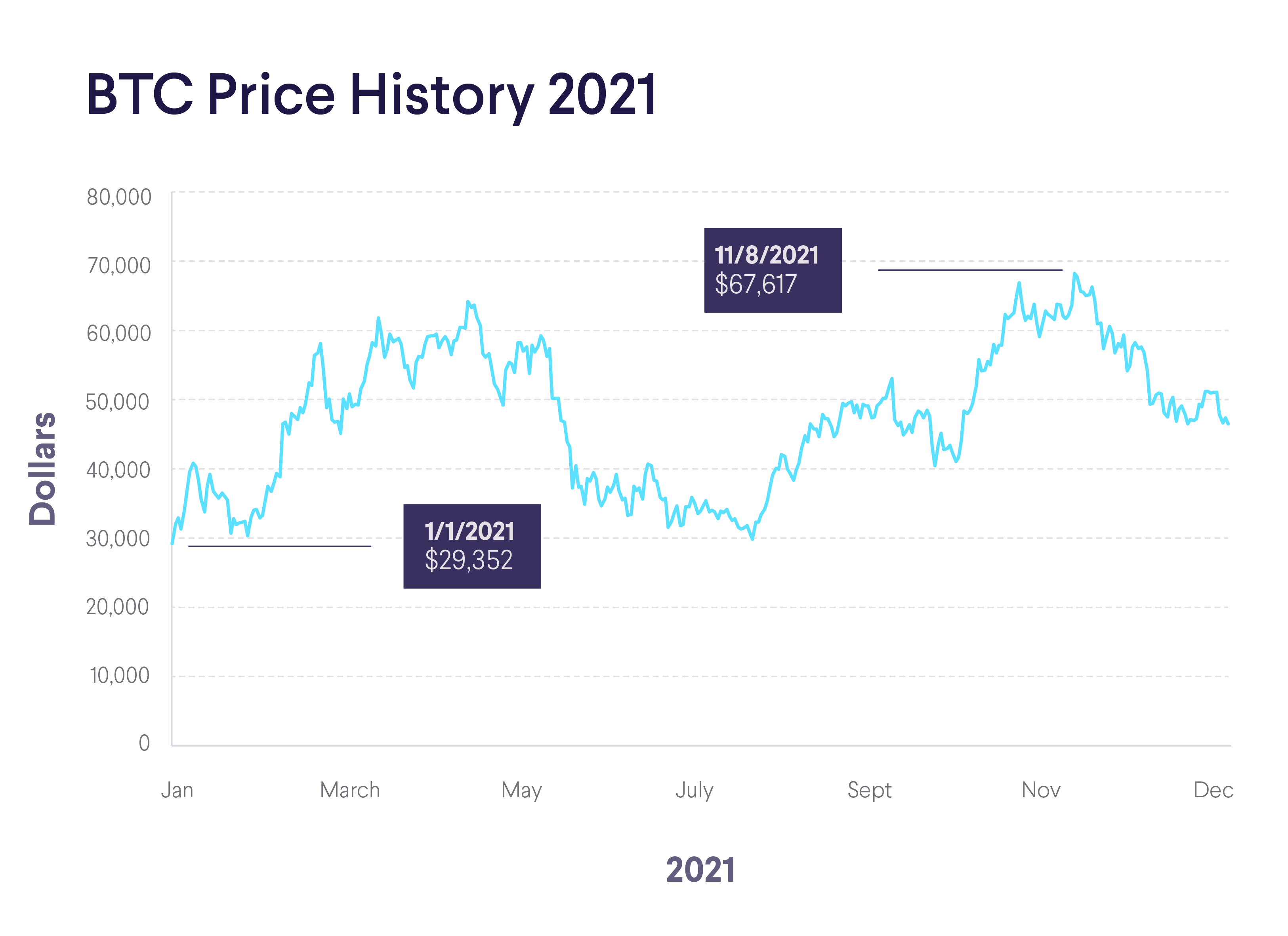

- Historical Data: Allows for in-depth analysis of Bitcoin's price fluctuations over time.

- Trading Volume: Indicates the number of Bitcoin transactions occurring within a specific time frame.

- Market Sentiment: Comprehends the collective attitude and expectations of traders towards Bitcoin.

Understanding these aspects collectively presents a comprehensive view of Bitcoin's dynamic price behavior. Real-time price and conversion enable informed trading decisions, while market updates, historical data, and trading volume provide context for price movements. Market sentiment, often expressed through news, social media, and trading platforms, further solidifies the assessment of Bitcoin's position in the financial markets.

Bitcoin price suddenly shoots up by ,000 as gold hits all-time high - Source www.independent.co.uk

Bitcoin USD: Real-Time Price, Conversion, And Market Updates

The value of Bitcoin against the US dollar (USD) is constantly fluctuating, with various factors influencing its price. The price of Bitcoin depends heavily on its supply and demand, which are both driven by multiple factors, including economic conditions, regulatory changes, and market sentiment. Volatility is inherent in the cryptocurrency market, and Bitcoin is not immune to these fluctuations, making real-time tracking of its price crucial for investors and traders who need accurate information to make informed decisions. Currency exchange and conversion rates are also essential for those transacting in Bitcoin globally, as they help determine the exact value they receive when buying or selling in different currencies.

The market updates section provides valuable insights into the latest developments, news, and events surrounding Bitcoin and the broader cryptocurrency industry. By staying informed, individuals can make more educated decisions about their investments and stay updated on the rapidly evolving digital asset landscape. This section often covers market trends, regulatory changes, industry analysis, and expert opinions, helping investors navigate the complexities of the Bitcoin market and make informed decisions.

![[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years [New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years](https://img.currency.com/imgs/articles/1668xx/shutterstock_763067344.jpg)

[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years - Source currency.com

Understanding the connection between real-time price, conversion, and market updates is pivotal for anyone invested in or interested in Bitcoin. Real-time price tracking allows for informed decision-making and timely responses to market movements, while conversion rates ensure accurate transactions in different currencies. Market updates provide insights into industry developments and help investors stay ahead of the curve. Collectively, these elements provide a comprehensive view of the Bitcoin market and enable effective participation for both experienced traders and new entrants.

Table: Importance of Real-Time Price, Conversion, and Market Updates for Bitcoin USD

| Aspect | Importance |

|---|---|

| Real-Time Price | Enables monitoring of price fluctuations and timely decision-making |

| Conversion Rates | Ensures accurate transactions and understanding of value in different currencies |

| Market Updates | Provides knowledge of industry trends and helps stay informed about regulatory changes and market sentiment |

Conclusion

The exploration of "Bitcoin USD: Real-Time Price, Conversion, And Market Updates" highlights the dynamic and interconnected nature of the Bitcoin market, where price, conversion, and market updates play crucial roles in informed decision-making. Real-time price tracking empowers investors with the ability to navigate market volatility, while conversion rates ensure accurate transactions across different currencies. Market updates offer valuable insights into industry developments, helping individuals stay informed about regulatory changes and market sentiment. By leveraging these key components, investors and traders can effectively participate in the Bitcoin market and make informed choices.

As the digital asset landscape continues to evolve, staying abreast of real-time price, conversion rates, and market updates will be essential for success in the Bitcoin market. This information empowers investors with the knowledge and tools necessary to make informed decisions, manage risk, and capitalize on opportunities. Embracing this comprehensive approach will contribute to a more informed and dynamic Bitcoin market, benefiting both individual investors and the industry as a whole.