What drives the Performance Analysis And Insights Into The TSX Index? When it comes to Performance Analysis And Insights Into The TSX Index, there is a lot to look at. Let's get started with the basic fact of what the Performance Analysis And Insights Into The TSX Index is.

Editor's Notes: Performance Analysis And Insights Into The TSX Index has published today date. The Performance Analysis And Insights Into The TSX Index is one of the most important indexes of stock market performance in Canada. It is made up of the 300 largest and most liquid companies listed on the Toronto Stock Exchange (TSX). The index is a barometer of the overall health of the Canadian economy, and it is closely watched by investors and analysts around the world.

Our team has done some analysis and digging information, made Performance Analysis And Insights Into The TSX Index we put together this Performance Analysis And Insights Into The TSX Index guide to help target audience make the right decision.

Key differences or Key takeways:

| Description | |

|---|---|

| Start Date of Performance Analysis And Insights Into The TSX Index | January 1, 1970 |

| End Date of Performance Analysis And Insights Into The TSX Index | Present |

| Number of Companies in Performance Analysis And Insights Into TSX Index | 300 |

| Weighting of Companies in Performance Analysis And Insights Into The TSX Index | Market capitalization |

| Performance of Performance Analysis And Insights Into The TSX Index | The TSX has outperformed the S&P 500 over the long term. |

Transition to main article topics

The Performance Analysis And Insights Into The TSX Index is a valuable tool for investors who are looking to gain exposure to the Canadian stock market. The index provides a diversified portfolio of some of the largest and most successful companies in Canada. The index is a good way to get a broad overview of the Canadian stock market, and it can also be used as a benchmark against which to compare the performance of individual stocks.

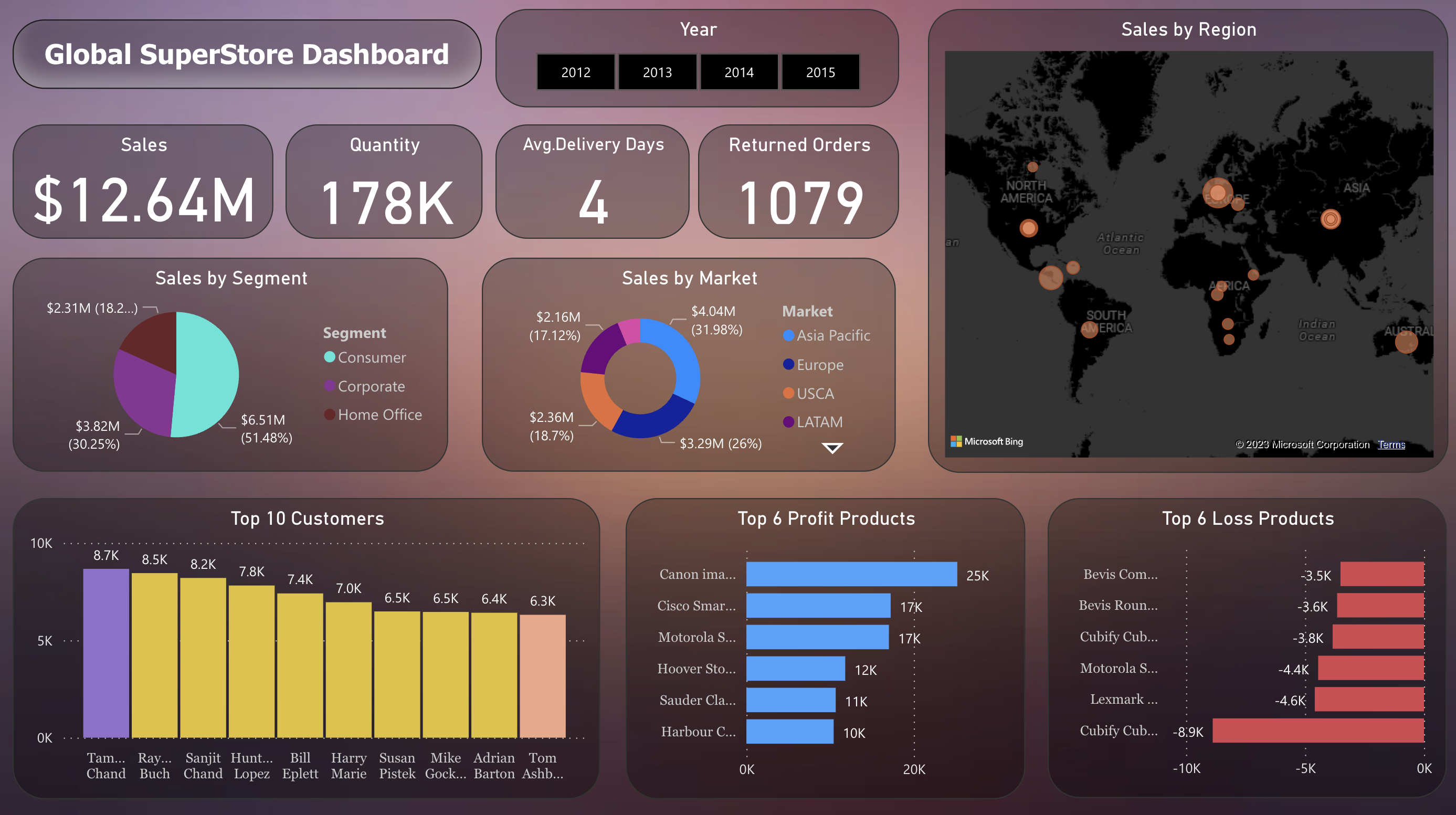

Global SuperStore Dashboard | Metricalist - Source metricalist.com

FAQ

This FAQ section provides comprehensive answers to commonly asked questions and addresses misconceptions about the Performance Analysis And Insights Into The TSX Index.

Question 1: What factors influence the performance of the TSX Index?

The TSX Index is influenced by a multitude of macroeconomic, political, and industry-specific factors. These factors include interest rate fluctuations, changes in government policies, global economic conditions, and the performance of major sectors within the Canadian economy, such as energy, financials, and materials.

Question 2: How is the TSX Index calculated?

The TSX Index is a capitalization-weighted index, meaning that the market capitalization of each company in the index influences its weight. The index is calculated by multiplying the share price of each company by the number of outstanding shares and then summing the results. The index level is then adjusted for stock splits and other corporate actions.

Question 3: What are the top-performing sectors within the TSX Index?

The top-performing sectors within the TSX Index vary over time, depending on market conditions. However, some sectors that have historically performed well include energy, financials, and materials. These sectors are heavily influenced by global economic conditions and commodity prices.

Question 4: How can investors track the performance of the TSX Index?

There are several ways to track the performance of the TSX Index. Investors can use financial websites, mobile apps, or broker platforms to view the index level and historical data. Additionally, many investment funds and exchange-traded funds (ETFs) track the TSX Index, allowing investors to gain exposure to the index through a single investment.

Question 5: What are the risks associated with investing in the TSX Index?

As with any investment, there are risks associated with investing in the TSX Index. These risks include the potential for market downturns, sector-specific risks, and geopolitical uncertainties. Investors should carefully consider their investment goals and risk tolerance before investing in the TSX Index or any other investment.

Question 6: How can investors mitigate the risks of investing in the TSX Index?

Investors can mitigate the risks of investing in the TSX Index by diversifying their portfolios across different asset classes and sectors. Additionally, investors should consider investing for the long term, as the TSX Index has historically rebounded from market downturns over time.

By understanding these factors, investors can make informed decisions about investing in the TSX Index and other Canadian equity markets.

Tips

This article provides expert insights into the TSX Index. To maximize returns and navigate market fluctuations, consider the following tips:

Tip 1: Diversify Your Portfolio

Spread investments across various industry sectors and asset classes to mitigate risk. This approach helps reduce portfolio volatility and enhances long-term returns.

Tip 2: Invest for the Long Term

Short-term market fluctuations are inevitable. By investing with a long-term perspective, investors can ride out market downturns and capitalize on upward trends.

Tip 3: Rebalance Regularly

Over time, asset allocation may deviate from target ratios. Regular rebalancing ensures optimal risk-return balance and aligns with investment goals.

Tip 4: Consider Dividend-Paying Stocks

Dividend payments provide a steady stream of income. Reinvesting dividends can compound returns and enhance portfolio growth over the long term.

Tip 5: Be Aware of Market Trends

Stay informed about economic indicators, geopolitical events, and industry news. This knowledge enables investors to make informed decisions and adjust strategies as required.

Tip 6: Seek Professional Advice

If necessary, consult a financial advisor who can provide personalized guidance and support. They can help create a tailored investment plan that meets specific needs.

Tip 7: Stay Disciplined

Adhere to the investment plan and resist making impulsive decisions based on market emotions. Discipline leads to consistency and improves overall investment outcomes.

By implementing these tips, investors can increase their chances of achieving financial success in the TSX Index.

Performance Analysis And Insights Into The TSX Index

Performance analysis and insights into the Toronto Stock Exchange (TSX) Index are critical for understanding the market's performance and identifying investment opportunities.

- Historical performance: Tracking the TSX Index's value over time provides insights into market trends and cycles.

- Sector analysis: Examining the performance of different sectors within the TSX Index can reveal industry-specific opportunities.

- Company analysis: Evaluating the performance of individual companies listed on the TSX Index helps in identifying potential investments.

- Economic indicators: Analyzing macroeconomic factors such as interest rates and GDP growth can impact the TSX Index's performance.

- Global market trends: Considering the influence of global markets and events on the TSX Index is essential.

- Investor sentiment: Understanding market sentiment and investor psychology can provide insights into future market behavior.

These key aspects provide a comprehensive framework for analyzing the TSX Index's performance and gaining valuable insights. By considering historical performance, sector dynamics, company fundamentals, economic indicators, global trends, and investor sentiment, investors can make informed investment decisions and navigate market volatility more effectively.

Student Performance Analysis Table Excel Template And Google Sheets - Source slidesdocs.com

Performance Analysis And Insights Into The TSX Index

Performance analysis is a crucial aspect of understanding the TSX Index, providing insights into its behavior, trends, and potential investment opportunities. By analyzing historical data, such as price movements, volume, and market capitalization, investors can gain valuable insights into the overall health and performance of the index. This analysis can help investors make informed decisions and tailor their investment strategies accordingly.

Sales Performance Analysis And Comparison Table Excel Template And - Source slidesdocs.com

The TSX Index is a market capitalization-weighted index that tracks the performance of the largest and most liquid companies listed on the Toronto Stock Exchange. It serves as a benchmark for the Canadian equity market and is widely used by investors to track the overall performance of the Canadian stock market. Performance analysis of the TSX Index can involve examining its historical returns, volatility, and correlation with other indices and asset classes.

Insights derived from performance analysis can assist investors in identifying undervalued or overvalued sectors, assessing risk and reward profiles, and making informed decisions about portfolio allocation. Furthermore, performance analysis can help investors identify potential trading opportunities, such as buying undervalued stocks or selling overvalued stocks.

Regularly monitoring and analyzing the TSX Index performance is essential for investors looking to stay informed about the Canadian market and make sound investment decisions. By understanding the index's historical behavior, investors can better navigate market fluctuations and position their portfolios for potential growth.