Want to take the mystery out of dollar investing and unlock financial success? "Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health" provides a roadmap to help you achieve your financial goals.

Editor's Note: "Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health" has been published today, offering an in-depth look at dollar investing strategies. In today's complex financial landscape, understanding how to make your dollars work for you is more important than ever.

Through dedicated analysis and research, we've compiled this comprehensive guide to empower you with the knowledge and strategies you need to navigate the world of dollar investing. Whether you're a seasoned investor or just starting out, this guide provides valuable insights and practical tips to help you make informed investment decisions and achieve financial well-being.

Key Differences or Key Takeaways:

Transition to main article topics:

FAQ

This FAQ section offers answers to common questions and concerns related to dollar investing. Explore these informative Q&A pairs to gain a deeper understanding of the concepts discussed in Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health.

Question 1: Is dollar investing suitable for beginners?

Dollar investing can be a suitable option for beginners who are new to investing. Its simplicity and low investment threshold make it an accessible way to start building a diversified portfolio.

Question 2: What are the potential risks involved in dollar investing?

As with any investment, dollar investing carries certain risks. These include market fluctuations, currency exchange rate variations, and the potential for default by the underlying companies or governments.

Question 3: How can I diversify my dollar investment portfolio?

Diversifying your dollar investment portfolio is crucial to reduce risk. Consider investing in different asset classes, such as stocks, bonds, and real estate, and spreading your investments across various industries and geographic regions.

Question 4: Is it necessary to have a large sum of money to start dollar investing?

No, dollar investing allows you to start with small amounts. The gradual accumulation of investments over time, through regular contributions, can help you build a substantial portfolio even with limited initial capital.

Question 5: How often should I review and adjust my dollar investment strategy?

Regularly reviewing and adjusting your dollar investment strategy is advisable. Monitor market conditions, assess your risk tolerance, and make necessary adjustments to ensure it aligns with your investment goals and circumstances.

Question 6: What are the tax implications of dollar investing?

The tax implications of dollar investing vary depending on your country of residence and the specific investments you make. Consult with a qualified tax professional to understand the tax laws applicable to your situation.

The Ultimate Guide to Real Estate Investing - Rentastic Blogs - Source www.rentastic.io

By addressing these common questions, we aim to enhance your understanding of dollar investing and empower you to make informed decisions as you navigate the intricacies of the global financial markets.

To delve deeper into the world of dollar investing, consider exploring the comprehensive guide: Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health.

Tips

It is essential to approach dollar investing with a knowledge of its nuances and best practices. This guide presents a comprehensive overview of the topic, empowering you to make informed decisions and maximize your financial potential.

Tip 1: Diversify Your Portfolio

Avoid concentrating investments in a single asset class or sector. Spread out your funds across various categories, such as stocks, bonds, real estate, and commodities. This strategy helps mitigate risk and enhances the chances of consistent returns.

Tip 2: Invest for the Long Term

Dollar investing is a long-term game that requires patience. Short-term fluctuations in the market should not deter you from the ultimate goal of wealth accumulation. Maintain a consistent investment strategy and ride out market downturns to reap the benefits over time.

Tip 3: Rebalance Your Portfolio Regularly

As your portfolio grows, it is essential to periodically adjust its composition to maintain the desired asset allocation. Rebalancing ensures that each asset class contributes appropriately to your overall risk and return profile, maximizing diversification benefits.

Tip 4: Invest in Quality Companies

Focus on investing in well-established companies with a track record of financial stability, strong management teams, and sustainable competitive advantages. These companies are more likely to weather economic storms and provide reliable returns.

Tip 5: Take Advantage of Tax-Advantaged Accounts

Utilize retirement accounts, such as 401(k)s and IRAs, to reduce tax liability on investment earnings. Tax savings accumulate over time, compounding investment growth and boosting your nest egg.

Tip 6: Monitor Your Investments Regularly

Stay informed about market trends and company financial performance. Regularly review your portfolio's progress and make adjustments as needed. Monitoring allows you to capitalize on opportunities and mitigate risks.

Tip 7: Seek Professional Advice When Needed

If you lack confidence or expertise in investing, consider seeking guidance from a financial advisor. They can provide personalized advice based on your financial goals, risk tolerance, and investment horizon.

Tip 8: Stay Disciplined and Patient

Investing requires discipline and patience. Stick to your investment strategy, avoid emotional decision-making, and ride out market fluctuations. Remember that consistent, long-term investing is the key to financial success.

By adhering to these tips, you can enhance your dollar investing strategy and position yourself for financial growth. Remember, investing is a journey, not a destination. By embracing these best practices, you can navigate market challenges and achieve your financial objectives.

Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health

Dollar investing presents a world of opportunities for financial growth. Embarking on this path requires a thorough understanding of its complexities. This comprehensive guide unveils six key aspects that illuminate the secrets of dollar investing.

- Diversification: Spread investments across different assets to reduce risk.

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals to mitigate market fluctuations.

- Compounding: Harness the power of exponential returns through reinvested earnings.

- Currency Hedging: Protect investments from currency fluctuations using financial instruments.

- Economic Indicators: Monitor economic data to make informed investment decisions.

- Long-Term Horizon: Embrace a patient approach to reap the full benefits of dollar investing.

Accountant Questions for a Comprehensive Financial Review - Source cloudcfo.ph

By mastering these aspects, investors can unlock the potential of dollar investing and pave the way for a brighter financial future. The journey requires discipline, research, and a sound understanding of market dynamics. Embracing these principles can transform dollar investing into a powerful tool for long-term wealth creation.

Unveiling The Secrets Of Dollar Investing: A Comprehensive Guide To Boost Your Financial Health

This guide provides a comprehensive overview of dollar investing, covering everything from the basics to more advanced strategies. It is an essential resource for anyone who wants to learn more about dollar investing and how it can help them achieve their financial goals.

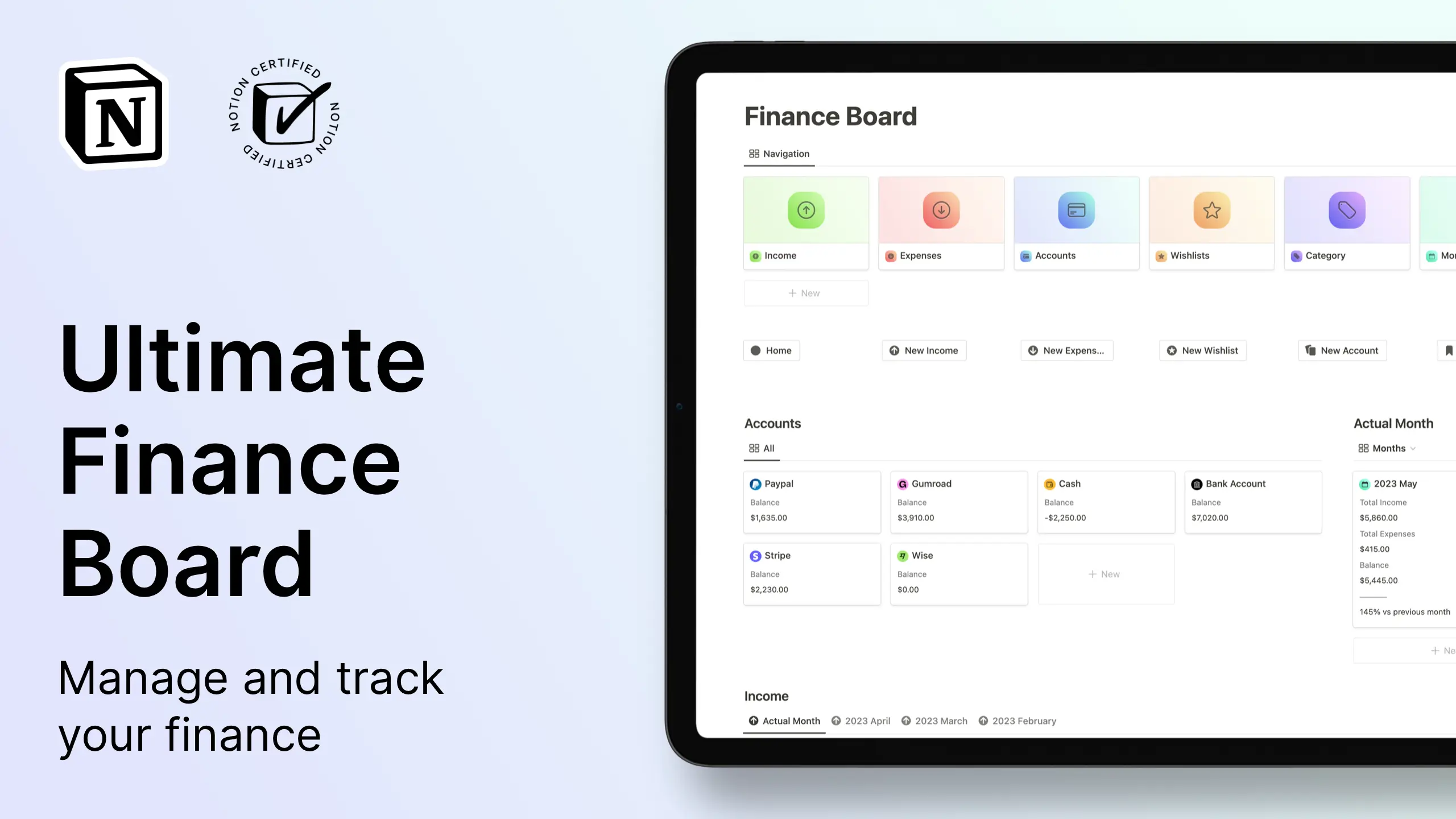

Notion Ultimate Finance Board | Notionhub - Source www.notionhub.net

One of the most important things to understand about dollar investing is the connection between the value of the dollar and the value of investments. When the dollar is strong, investments in dollar-denominated assets will tend to perform well. Conversely, when the dollar is weak, investments in dollar-denominated assets will tend to perform poorly.

It is also important to understand the different types of dollar investments that are available. There are two main types of dollar investments: spot investments and forward investments. Spot investments are investments that are made in the present, while forward investments are investments that are made for future delivery.

Spot investments are typically made in the form of cash deposits or purchases of dollar-denominated assets, such as stocks, bonds, or real estate. Forward investments are typically made in the form of futures contracts or options contracts. Futures contracts are contracts to buy or sell a certain amount of an asset at a certain price on a certain date. Options contracts are contracts that give the buyer the right, but not the obligation, to buy or sell a certain amount of an asset at a certain price on a certain date.

Dollar investing can be a great way to boost your financial health. By understanding the connection between the value of the dollar and the value of investments, and by choosing the right types of dollar investments, you can position yourself to achieve your financial goals.

| Dollar Investment Type | Description |

|---|---|

| Spot Investments | Investments that are made in the present. |

| Forward Investments | Investments that are made for future delivery. |

Conclusion

Dollar investing is a complex but potentially lucrative investment strategy. By understanding the connection between the value of the dollar and the value of investments, and by choosing the right types of dollar investments, you can position yourself to achieve your financial goals.

However, it is important to remember that all investments carry some degree of risk. Before investing in any dollar investment, it is important to do your research and understand the risks involved.