Editor's Notes: "Property Valuation And Assessment Services For British Columbia" have published today date, to help you. We analyzed and dug information to put together this Property Valuation And Assessment Services For British Columbia guide to help you make the right decision.

We understand how important it is to get the right Property Valuation And Assessment Services For British Columbia, which is why our team has put together this comprehensive overview of the most important things you'll need to know before making a choice. We've analyzed, dug information, compared, and contrasted the top Property Valuation And Assessment Services For British Columbia so you don't have to do the time-consuming research yourself

Key differences or Key takeaways

| Criteria | Information |

|---|---|

| 1 | Understanding of market condition |

| 2 | Expertise in the latest valuation methods |

| 3 | Knowledge if the local area |

Now let's move on to the main article body

FAQ

Property valuations for the purposes of taxation are conducted by BC Assessment. These valuations are commonly referred to as assessments.

Assessor | York, SC - Source www.yorkcountygov.com

Question 1: How do I know if my property assessment is correct?

Property owners can check their property assessment online through BC Assessment's website.

Question 2: What is the difference between a property assessment and a property appraisal?

A property assessment is a valuation of a property for the purposes of taxation, while a property appraisal is a valuation of a property for a specific purpose, such as a mortgage or sale.

Question 3: Can I appeal my property assessment?

Yes, property owners can appeal their property assessment if they believe it is incorrect. Appeals must be filed with the BC Assessment Authority.

Question 4: What is the deadline for filing an appeal?

The deadline for filing an appeal varies depending on the year. Property owners should check the BC Assessment website for the current deadline.

Question 5: What happens if I miss the deadline for filing an appeal?

If a property owner misses the deadline for filing an appeal, they can still request a review of their assessment. However, the review process is more limited than the appeal process.

Question 6: How can I get help with my property assessment?

Property owners can get help with their property assessment by contacting BC Assessment. BC Assessment offers a variety of resources and services to help property owners understand their property assessment and the appeals process.

For more information about Property Valuation And Assessment Services For British Columbia, please visit the BC Assessment website.

Tips

To ensure accurate property valuation and assessment, consider the following tips from Property Valuation And Assessment Services For British Columbia:

Tip 1: Gather necessary documents.

Before submitting a valuation request, gather essential documents such as property tax bill, deed, building permits, and recent appraisals. These documents provide crucial information for accurate assessment.

Tip 2: Consider property condition.

The condition of a property significantly influences its value. Assess the state of the property's structure, roof, plumbing, electrical system, and other components. Note any repairs or renovations that may have impacted the property's market value.

Tip 3: Determine comparable properties.

Identify comparable properties in the same neighborhood with similar characteristics, such as size, type, and amenities. Analyzing recent sales data of these properties helps establish a value range for your property.

Tip 4: Consult with professionals.

Consider seeking guidance from a qualified appraiser or property valuation expert. Professionals possess expertise in assessing property values and can provide unbiased and informed opinions.

Tip 5: Be responsive to requests.

Once you submit a valuation request, promptly respond to any additional information or clarification required by the assessment service. Cooperation facilitates a smoother and more accurate valuation process.

Summary:

By following these tips, property owners can enhance the accuracy of their property valuations. Accurate assessments ensure fair taxation and provide a solid foundation for financial planning.

Property Valuation And Assessment Services For British Columbia

Understanding the crucial aspects of property valuation and assessment services in British Columbia is essential for real estate professionals, investors, and homeowners alike. Here are six key aspects to consider:

- Property Types: Encompasses residential, commercial, industrial, and rural properties.

- Market Analysis: Involves studying recent sales, comparable properties, and economic indicators to determine market value.

- Appraisal Methods: Utilizes different techniques such as the cost, sales comparison, and income approaches to estimate value.

- Assessment Process: Conducted by the British Columbia Assessment Authority, determines the assessed value for property tax purposes.

- Assessment Notices: Annual notices sent to property owners, detailing assessed value and tax liability.

- Dispute Resolution: Provides avenues for property owners to challenge assessed values through the Property Assessment Review Panel.

These aspects interconnect to form a comprehensive system for determining property value and assessing property taxes in British Columbia. By understanding these key elements, individuals can make informed decisions and navigate the property valuation and assessment process effectively.

Property Valuation QLD. Find the Value of Your Home Online in Just a - Source www.calibrerealestate.com.au

Property Valuation And Assessment Services For British Columbia

Property valuation and assessment services are essential for British Columbia's property tax system. These services ensure that properties are assessed fairly and accurately, which is important for generating revenue for local governments and providing fair property taxes to homeowners. Property valuation and assessment services also play a vital role in the real estate market, as they provide buyers and sellers with information about the value of properties.

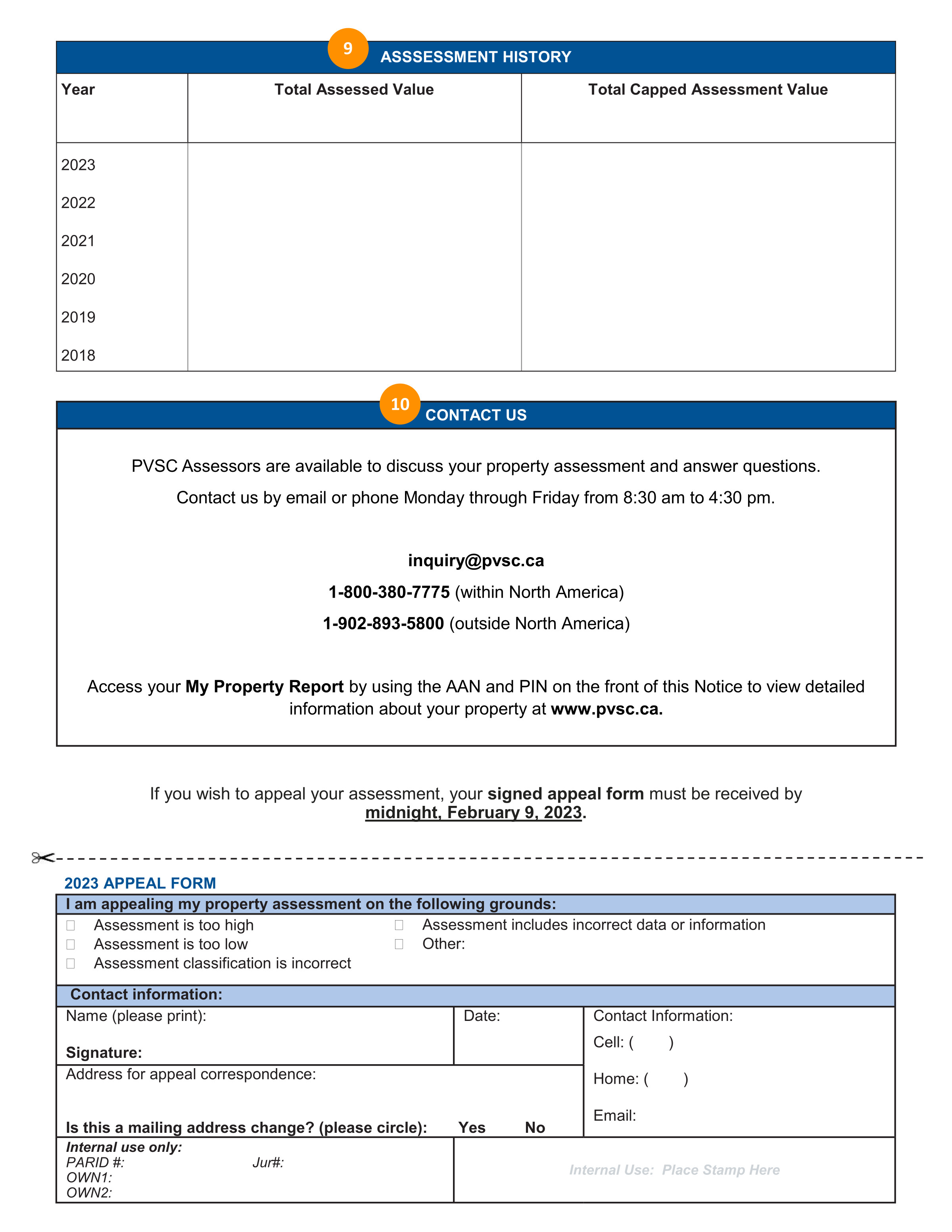

Your Property Assessment Notice | Property Valuation Services Corporation - Source www.pvsc.ca

In British Columbia, property valuation and assessment services are provided by the BC Assessment Authority (BCA). The BCA is an independent agency that is responsible for assessing the value of all properties in the province. The BCA uses a variety of methods to assess property values, including market data, comparable sales, and cost data. The BCA also considers factors such as location, size, and condition when assessing property values.

The BCA's property assessments are used by local governments to determine property taxes. Property taxes are a major source of revenue for local governments, and they are used to fund a variety of public services, such as schools, hospitals, and roads. Property taxes are also used to fund special assessments, such as those for sewer and water projects.

Property valuation and assessment services are an important part of British Columbia's property tax system. These services ensure that properties are assessed fairly and accurately, which is important for generating revenue for local governments and providing fair property taxes to homeowners. Property valuation and assessment services also play a vital role in the real estate market, as they provide buyers and sellers with information about the value of properties.

| Property Type | Assessment Value | Property Tax |

|---|---|---|

| Residential | $500,000 | $3,000 |

| Commercial | $1,000,000 | $6,000 |

| Industrial | $2,000,000 | $12,000 |

Conclusion

Property valuation and assessment services are an essential part of British Columbia's property tax system. These services ensure that properties are assessed fairly and accurately, which is important for generating revenue for local governments and providing fair property taxes to homeowners. Property valuation and assessment services also play a vital role in the real estate market, as they provide buyers and sellers with information about the value of properties.

The BCA is committed to providing fair and accurate property valuations and assessment services to British Columbians. The BCA uses a variety of methods to assess property values, and it considers factors such as location, size, and condition when assessing property values. The BCA also provides a number of resources to help property owners understand the property assessment process.